Financial Services

Discover Many Of The Opportunities Available To Help You Plan For Your Financial FutureFiduciary Vs. Suitability

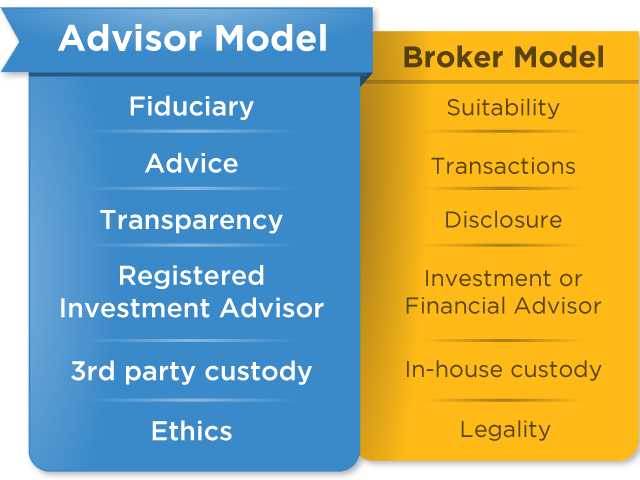

Deciphering the “what’s what” and “who’s who” of today’s complex financial services industry can be difficult, even for the most financially sophisticated members of the general investing public. Two words — fiduciary and suitability — are critical in understanding the motivation behind the person offering you financial products or advice.

Recognizing the difference between the fiduciary and suitability standards may also help you to appreciate the level of care you receive from a trusted financial advisor. Though the distinction between the fiduciary and suitability methods of offering advice is rarely discussed by large, “broker-led” financial companies, we feel it is essential for investors to know the difference.

Our firm believes the fiduciary model of disclosure and transparency is now in the best interests of the client.

Broker

The Suitability Standard

Offers products for sale from a range of products carried by the company he or she represents.

Is paid commissions calculated as a percentage of the amount of money invested into the product.

Advisor

The Fiduciary Standard

Offers “best advice” taking into account the needs of each individual client.

Is paid a quarterly fee calculated as a percentage of the assets under advisement.

The Fiduciary Standard Requires Advice To Be Provided In The Best Interests Of The Client Including The Disclosure Of Possible Conflicts Of Interest.

The suitability standard states that a broker only needs to check the suitability of a prospective buyer, based primarily upon financial objectives, current income level and age, in order to complete a commissionable sale of a financial product. In a way, when a broker checks the suitability of a potential buyer, he or she is measuring how much financial product can be sold, not the needs of the investor. No disclosure of possible conflicts of interest is required. Common differences between the two standards involve trading commissions.

Why Should You Care?

The differences discussed above were a contributor to the 2008 credit crisis, especially within the selling of complex financial products based on housing debt. More recently, the initial public offering (IPO) of Facebook stock was roiled by alleged conflicts of interest by those offering the stock.

Every day, financial products are sold for a commission and include internal costs and fees that are difficult to find and define. The dollar value of these commissions and additional internal costs are usually deducted from the amount an investor invests in a financial product. The total return of such a product may therefore be reduced by the value of these hidden costs.