The Antidote To A Stressful Retirement

‘Into the great unknown’ is a wonderful phrase to setup a big screen sci-fi thriller, or a dramatic novel, but seeing your retirement through this lens can cause many people to shudder a bit, and for good reason.

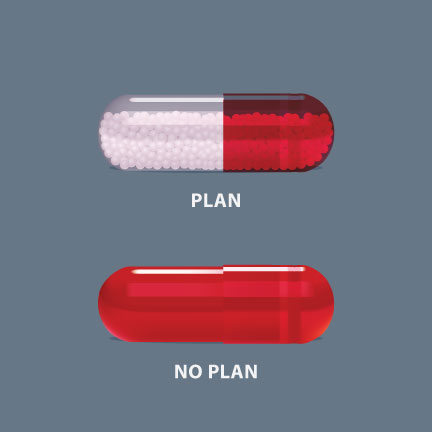

After investing three or four decades into a career and amassing savings to support yourself through a non-paid retirement of similar length can be downright terrifying. Consider the unknowns for the typical retiree: rising healthcare costs, inflation, historically low interest rates, a precipitously inflated stock market…it’s no wonder people are feeling stressed! Given all of these variables that are seemingly beyond our control, I present to you the very antidote to a stressful retirement: a retirement plan.

As a retirement planner, I have the unique vantage point of having seen hundreds of families’ retirement savings strategies, goals, objectives, hopes, and dreams. While each of these families has very different dynamics, one common thread runs through all of them: Do we have enough saved, and are we prepared for a changing future? And sadly, many people are stepping into their retirement – into the great unknown – without a plan. This lack of a written, stress-tested plan is what causes many people to lose sleep at night when contemplating their retirement readiness. It simply doesn’t have to be this way.

Imagine for a moment that you’ve organized all of your financial statements, including investment and retirement accounts, annuities, social security benefits estimates, pension options, life insurance policies, long term care policies, bank account statements, estate planning documents, all of them, in one place. Then consider having these all analyzed to ensure you’re taking the appropriate amount of risk for your circumstances, that you’re paying reasonable fees for the services rendered, you have adequate income to last a lifetime, your vulnerabilities are properly insured against, and all of this is documented in a planning construct that makes it begin to make sense to you. Can you imagine how that might reduce your stress when making the decision to walk away from paid employment? Yet, it’s much more rare than I care to think about.

The old adage, ignorance is bliss, really holds little water for the aspiring retiree. Sure, if you don’t know about something, how can you fear it, but what if you now know that you should know? Well, many people have invested money into financial products with little knowledge of how those investments are to be used to get them retired and keep them retired. More often than not, account statements that arrive in the mail, or by email, get scanned quickly with the hope that everything just works out somehow because nobody ever put those numbers into proper context. In other words, that money lacks a plan for how to best utilize it.

Want less stress in retirement? Then I’d encourage you to plan for a less stressful retirement by planning for each dollar that you’re worked so hard to save to work as hard as possible for your benefit. It may sound like a lot of work, but it doesn’t have to be. In fact, a little effort on the front end will likely save a lot of worry and stress on the back end. A small investment in time can reap huge rewards in peace of mind.

Investment Advisory Services offered through Elevated Capital Advisors, LLC. An SEC Registered Investment Advisor.

This newsletter/commentary should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. There is no guarantee that any investment plan or strategy will be successful. All references to potential future developments or outcomes are strictly the views and opinions of the author and in no way promise, guarantee, or seek to predict with any certainty what may or may not occur in various economies and investment markets.