Report: Helpful Information for Filing 2019 Income Taxes

Helpful Information for Filing 2018 Income Taxes and Proactive Tax Planning for 2019

Tax planning should always be a key focus when reviewing your personal financial situation. One of our goals as financial professionals is to highlight tax savings opportunities and strategies so that you pay only your fair share of taxes and no more.

Tax planning should always be a key focus when reviewing your personal financial situation. One of our goals as financial professionals is to highlight tax savings opportunities and strategies so that you pay only your fair share of taxes and no more.

This special report reviews some of the broader tax law changes along with a wide range of tax reduction strategies. As you review this report, please take note of each tax strategy that you think could be beneficial to you; not all ideas are appropriate for all taxpayers. We always recommend that you address any tax strategy with your tax professional to consider how one tax strategy may affect another when calculating the income tax consequences (both state and federal). It’s important to note that tax strategies and concepts that may have been effective in the past may not even be available under today’s new tax laws. Always attempt to understand all the details before making any decisions—it is always easier to avoid a problem than it is to solve one.

Please note—your state income tax laws could be different from the federal income tax laws. Visit tax.findlaw.com for a wide range of tax information and links to tax forms for all 50 states. All examples mentioned in this report are hypothetical and meant for illustrative purposes only.

The beginning of the 2019 tax season was initially in question due to the partial government shutdown. On January 7, the Internal Revenue Service (IRS) assured taxpayers they would indeed begin processing tax returns on January 28, 2019. The deadline to file 2018 tax returns is Monday, April 15, 2019 for most taxpayers (those who live in Maine or Massachusetts have until April 17 to file due to Patriots’ Day holiday on April 15 and Emancipation Day on April 16 for the District of Columbia).

IRS Commissioner Chuck Rettig shared that, despite the government shutdown, “IRS employees have been hard at work over the past year to implement the biggest tax law changes the nation has seen in more than 30 years.” The IRS recalled furloughed employees to assist in the work required to process returns. (Source: www.irs.gov)

It turns out that even with a government shutdown, one thing you can still count on is the government collecting taxes. This year’s tax season brings major adjustments for the IRS, taxpayers, and tax preparers due to the tax law changes and new 2018 Form 1040 required to adhere to the rules created by the Tax Cut and Jobs Act (TCJA).

2018 Tax Law Updates

For the 2018 tax year, form 1040 has been completely redesigned. Form 1040, which many taxpayers generally file on its own, is now supplemented with new Schedules 1 through 6. These additional schedules will be used as needed to complete more complex tax returns. Forms 1040A and 1040EZ are no longer available. While we still have time to perform tax planning for your 2019 taxes, here are some items that 2018 tax filers should review.

2018 Tax Rates and Income Brackets

The number of federal income tax brackets for 2018 remains unchanged at seven. The lowest of the seven tax rates is 10%, while the top tax rate is now 37%. The income amounts that fall into each bracket are scheduled to be adjusted in 2019 for inflation. For 2018, please review the chart in this report to see which bracket your final income falls into.

TAX TIP: If you are not sure how best to file, ask your tax preparer, or review IRS Publication 17, Your Federal Income Tax, which is a complete tax resource.

It contains helpful information such as whether you need to file a tax return and how to choose your filing status.

2018 Standard Deduction Amounts

Most taxpayers claim the standard deduction. For 2018, the standard deduction has increased for all filers and has almost doubled in amount. Previously set at $6,350 for single tax filers and $12,700 for joint filers, the amounts are now $12,000 for single filers and $24,000 for those filing jointly ($18,000 for head of household filers). If you are filing as a married couple, an additional $1,300 is added to the standard deduction for each person age 65 and older. If you are single and age 65 or older, an additional deduction of $1,600 can be made.

Increased Child Tax Credit

For 2018, the maximum child tax credit has doubled to $2,000 per qualifying child, of which $1,400 (up from $1,100) can be claimed for the additional child tax credit. The bill also adds a new, non-refundable credit of $500 for dependents other than children. The modified adjusted gross income (MAGI) threshold at which the credit begins to phase out has increased to $200,000 (previously $110,000) and $400,000 for those married filing jointly.

New Tax Law Deduction Changes

Some deductions and exemptions allowed in previous years are now eliminated. In the past, those who used a standard deduction could also include a personal exemption if they were not a dependent. That personal exemption is no longer an option. Also, deductions for interest on home mortgages have been reduced, while the interest deduction on home equity loans eliminated.

There are also changes to state and local tax deductions. Under the new law, a taxpayer’s state and local tax (SALT) deduction is limited to $10,000. This includes both state income and property taxes. This might most affect taxpayers who live in states with high property taxes and those who pay larger State income tax bills. Several tax articles even suggest that some retirees might find it even more beneficial to move to a more tax-friendly state with lower property taxes in an effort to reduce their tax liabilities.

Medical Expense Deduction

The Tax Cuts and Jobs Act (TCJA) retroactively made the 7.5% medical expense deduction threshold available to any individual taxpayer regardless of age for 2017 and it remains the same for 2018. The 10% threshold amount returns in 2019. The TCJA tax bill also eliminates the tax penalty for not having health insurance after December 31, 2018.

TAX TIP: For 2018, taxpayers can deduct medical expenses that are over 7.5% of adjusted gross income as opposed to the higher 10% threshold coming in 2019.

Investment Income

Taxpayers with enough income to pay taxes at the highest 37% rate will now pay 20% on their net long-term capital gains and qualified dividends.

Since long-term capital gains are taxed at more favorable rates compared to ordinary income, one tax strategy is to review your investments that have unrealized long-term capital gains and sell enough of the appreciated investments in order to generate enough long-term capital gains to push you to the top of your federal income tax bracket. This strategy could be helpful if you are in the 0% capital gains bracket and do not have to pay any federal taxes on this gain. Then, if you want, you can buy back your investment the same day, increasing your cost basis in those investments. If you sell them in the future, the increased cost basis will help reduce long-term capital gains. You do not have to wait 30 days before you buy back this investment—the 30-day rule only applies to losses, not gains.

Note: This non-taxable capital gain for federal income taxes might not apply to your state.

TAX TIP: Remember that marginal tax rates on long-term capital gains and dividends may be higher than expected.

The 3.8% surtax can raise the effective rate to 18.8% for single filers with income from $38,601 to $425,800 and 23.8% for single filers with income above $479,000. It can raise the effective rate to 18.8% for married taxpayers filing jointly with income from $77,201 to $479,000 and to 23.8% for married taxpayers filing jointly with income above $479,000.

Calculating Capital Gains and Losses

TAX TIPS: Please remember to review your 2017 income tax return Schedule D (page 2) to see if you have any capital loss carryover for 2018. This is often overlooked, especially if you are changing tax preparers.

Please double-check your capital gains or losses. If you sold an asset outside of a qualified account during 2018, you most likely incurred a capital gain or loss. Sales of securities showing the transaction date and sale price are listed on the 1099 generated by the financial institution. However, your 1099 might not show the correct cost basis or realized gain or loss for each sale. You will need to know the full cost basis for each investment sold outside of your qualified accounts, which is usually what you paid for it, but this is not always the case.

3.8% Medicare Investment Tax

The year 2018 is the sixth year of the net investment income tax of 3.8%. This is also known as the Medicare surtax. If you earn more than $200,000 as a single or head of household taxpayer, $125,000 as married taxpayers filing separately or $250,000 as married joint return filers, then this tax applies to either your modified adjusted gross income or net investment income (including interest, dividends, capital gains, rentals, and royalty income), whichever is lower. This 3.8% tax is in addition to capital gains or any other tax you already pay on investment income.

A helpful strategy has been to pay attention to timing, especially if your income fluctuates from year to year or is close to the $200,000 or $250,000 amount. Consider realizing capital gains in years when you are under these limits. The inclusion limits may penalize married couples, so realizing investment gains before you tie the knot may help in some circumstances. This tax makes the use of depreciation, installment sales, and other tax deferment strategies suddenly more attractive.

Medicare Health Insurance Tax on Wages

If you earn more than $200,000 in wages, compensation, and self-employment income ($250,000 if filing jointly, or $125,000 if married and filing separately), the Affordable Care Act levies a special 0.9% tax on your wages and other earned income. You’ll pay this all year as your employer withholds the additional Medicare Tax from your paycheck. If you’re self-employed, plan for this tax when you calculate your estimated taxes.

If you’re employed, there’s little you can do to reduce the bite of this tax. Requesting non-cash benefits in lieu of wages won’t help—they’re included in the taxable amount. If you’re self-employed, you may want to take special care in timing income and expenses (especially depreciation) to avoid the limit.

Charitable Gifts and Donations

When preparing your list of charitable gifts, remember to review your checkbook register so you don’t miss any gifts. Most people remember to count the monetary gifts they make to their favorite charities, but you should also count noncash donations. Make it a priority to always get a receipt for every gift and keep your receipts. If your contribution totals more than $250, you’ll also need an acknowledgement from the charity documenting the support you provided. Remember that you’ll have to itemize to claim this deduction, but when filing, the expenses incurred while doing charitable work often is not included on tax returns.

You can’t deduct the value of your time spent volunteering, but if you buy supplies for a group, the cost of that material is deductible as an itemized charitable donation. You can also claim a charitable deduction for the use of your vehicle for charitable purposes, such as delivering meals to the homebound in your community or taking your child’s Scout troop on an outing. For 2018, the IRS will let you deduct that travel at .14 cents per mile.

Child and Dependent Care Credit

Millions of parents claim the Child and Dependent Care Credit each year to help cover the costs of after-school daycare while working. Some parents overlook claiming the tax credit for child care costs during the summer. This tax break can also apply to summer day camp costs. For deduction purposes, however, the camp can only be a day camp, not an overnight camp. So, If you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age, you may qualify for a tax credit of up to 35 percent of qualifying expenses of $3,000 for one child or dependent, or up to $6,000 for two or more children.

Contribute to Retirement Accounts

If you haven’t already funded your retirement account for 2018, consider doing so by April 15, 2019. That’s the deadline for contributions made to a traditional IRA (deductible or not) and a Roth IRA. However, if you have a Keogh or SEP and you get a filing extension to October 15, 2019, you can wait until then to make 2018 contributions into those accounts. To start tax-free compounding as quickly as possible, however, try not to delay in making contributions. If eligible, a deductible contribution will help you lower your tax bill for 2018 and your contributions will compound tax-deferred.

To qualify for the full annual IRA deduction in 2018, you must either: 1) not be eligible to participate in a company retirement plan, or 2) if you are eligible, there is a phase-out from $63,000 to $73,000 for singles and from $101,000 to $121,000 for married taxpayers filing jointly. If you are not eligible for a company plan but your spouse is, your traditional IRA contribution is fully-deductible as long as your combined gross income does not exceed $186,000. For 2018, the maximum IRA contribution you can make is $5,500 ($6,500 if you are age 50 or older by the end of the calendar year). For self-employed persons, the maximum annual addition to SEPs and Keoghs for 2018 is $55,000.

Although contributing to a Roth IRA instead of a traditional IRA will not reduce your 2018 tax bill (Roth contributions are not deductible), it could be the better choice because all withdrawals from a Roth can be tax-free in retirement. Withdrawals from a traditional IRA are fully taxable in retirement. To contribute the full $5,500 ($6,500 if you are age 50 or older by the end of 2018) to a Roth IRA, you must earn $120,000 or less a year if you are single or $189,000 if you’re married and file a joint return.

The amount you save from making a contribution will vary. If you are in the 22% tax bracket and make a deductible IRA contribution of $5,500, you will save $1,210 in taxes the first year. Over time, future contributions could save you thousands, depending on your contribution, income tax bracket and the number of years you keep the money invested. If you have any questions on retirement contributions, please call us.

Roth IRA Conversions

A Roth IRA conversion is the act of converting part or all of your traditional IRA into a Roth IRA. This is a taxable event. The entire amount you converted is subject to ordinary income tax. It might also cause your income to increase, thereby subjecting you to the Medicare surtax. Roth IRAs grow tax-free and withdrawals are tax-free in the future, a time when tax rates might be higher.

Whether to convert part or all of your traditional IRA to a Roth IRA depends on your particular situation. It is best to prepare a tax projection and calculate the appropriate amount to convert. Remember that you do not have to convert your entire IRA to a Roth. Roth IRA conversions are not subject to the pre-59½ early withdrawal penalty of 10%.

Many 401(k) plan participants can convert the pre-tax money in their 401(k) plan to a Roth 401(k) plan without leaving the job or reaching age 59½. There are a number of pros and cons to making this change. Please call us to see if this makes sense for you.

Inherited IRAs

Be careful if you inherit a retirement account. In many cases, the decedent’s largest asset is a retirement account. If you inherit a retirement account, such as an IRA or other qualified plan, the money is usually taxable upon receipt. There is no step-up in basis on investments within retirement accounts and therefore most distributions are 100% taxable.

Non-spouse beneficiaries usually cannot roll over an inherited IRA to their own IRA, but the solution to this problem can be easy: establish an Inherited IRA, also known as a “stretch” IRA. Non-spouse beneficiaries of any age are allowed to start their required minimum distributions (RMDs) the year after the owner died and stretch them out over their own life expectancy. This will reduce your income taxes significantly compared to having all of the IRA value taxed in one year. Please note that it is very important to take the RMD from an inherited IRA every year as penalties for not doing so are very severe – 50% of the amount you did not take.

These tax laws are very complicated and you must implement the requirements carefully to avoid any unnecessary income taxes and penalties. Please contact us before receiving any distributions from a retirement account you inherit. Remember, it is easier to avoid a problem than it is to solve one!

Required Minimum Distributions (RMD)

If you turned age 70½ during 2018, you still have until April 1, 2019, to withdraw your first RMD. This is a one-time opportunity in the event that you forgot the first time. The deadline for taking your RMD in the future will be December 31st of each year. If you do not complete your RMD by this deadline, you may be subject to a 50% penalty on the amount you were supposed to take out. If you have any questions on your Required Minimum Distributions please call us.

TAX TIP: You usually do not have to withdraw an RMD from your current employer’s retirement account as long as you’re still employed there and don’t own over 5% of the company. See your plan administrator if you have any questions.

Other Overlooked Tax Items and Deductions

Reinvested Dividends

This isn’t a tax deduction, but it is an important calculation that can save investors a bundle. Former IRS commissioner, Fred Goldberg, told Kiplinger magazine for their annual ‘overlooked deduction’ article that missing this break costs millions of taxpayers a lot in overpaid taxes.

Many investors have mutual fund dividends that are automatically used to buy extra shares. Because each reinvestment increases your tax basis in that fund, these dividends will, in turn, reduce the taxable capital gain (or increase the tax-saving loss) when you redeem shares. Please keep good records. Forgetting to include reinvested dividends in your basis results in double taxation of the dividends, once in the year when they were paid out and immediately reinvested, and later when they’re included in the proceeds of the sale. Don’t make that costly mistake.

If you’re not sure what your basis is, ask the fund or us for help.

Funds often report to investors the tax basis of shares redeemed during the year. Regulators currently require that for the sale of shares purchased, financial institutions must report the basis to investors and to the IRS.

Student-Loan Interest Paid by Parents

Generally, you can deduct interest only if you are legally required to repay the debt. But if parents pay back a child’s student loans, the IRS treats the transactions as if the money were given to the child, who then paid the debt. So as long as the child is no longer claimed as a dependent, the child can deduct up to $2,500 of student-loan interest paid by their parents each year. (The parents can’t claim the interest deduction even though they actually foot the bill because they are not liable for the debt).

Charitable Gift Directly made from IRA

Individuals at least 70½ years of age can still exclude from gross income, qualified charitable distributions (QCD) from IRAs of up to $100,000 per year. Please remember to double check what counts as a qualified charity and as a qualified distribution before using this tax strategy.

Proactive Tax Planning for 2019

With the passage of the Tax Cuts and Jobs Act (TCJA), tax brackets, thresholds, and tax rates changed for many filers in 2018. We will work to keep our clients updated during the year on potential strategies that may be helpful. For now, please review the 2019 tax brackets for single filers and married taxpayers filing jointly and the planning ideas listed in this report.

With the passage of the Tax Cuts and Jobs Act (TCJA), tax brackets, thresholds, and tax rates changed for many filers in 2018. We will work to keep our clients updated during the year on potential strategies that may be helpful. For now, please review the 2019 tax brackets for single filers and married taxpayers filing jointly and the planning ideas listed in this report.

Some Things Taxpayers Should Consider to Proactively Tax Plan for 2019

Prepare a 2019 tax projection Taxpayers already know the 2019 rates, and by reviewing their 2018 situation and all 2019 expectations of income, a qualified tax preparer could be able to help you with a tax projection for 2019.

Prepare a 2019 tax projection Taxpayers already know the 2019 rates, and by reviewing their 2018 situation and all 2019 expectations of income, a qualified tax preparer could be able to help you with a tax projection for 2019.

New contribution limits for retirement savings

For 2019, the annual contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is increased from $18,500 to $19,000. The limit on annual contributions to an IRA, which last increased in 2013, is increased from $5,500 to $6,000. The catch-up contribution limits for those 50 and over remain unchanged.

Explore if a potential Roth IRA conversion is helpful for your situation

A Roth IRA can be beneficial in your overall retirement planning. Investments in a Roth IRA have the potential to grow tax-free and they don’t have required minimum distributions (RMDs) during the lifetime of the original owner. Also, Roth IRA assets may pass to your heirs tax-free. Roth conversions include complex details and are not right for everyone, so please call us to see if this makes sense for you.

Take advantage of annual exclusion gifts

For 2019, the maximum amount of gift tax exemption is $15,000. This means you can give up to that amount to a family member without having to pay a gift tax to the IRS. Gifting options may include contributing to a working child (or grandchild’s) IRA, or gifting to a 529 plan, which is a tax-sheltered plan for college expenses.

Consider ‘bunching’ your charitable donations into a Donor Advised Fund (DAF)

Now is the time to explore if it’s helpful for your tax situation to deposit cash, appreciated securities, or other assets into a Donor Advised Fund, which then distributes your contributions to charities over time. Up to 50% of your adjusted gross income (AGI) may be deductible if given as donations to qualifying charities.

Look into Health Savings Accounts (HSAs)

In order to qualify to contribute to a health savings account in 2019, you must have a health insurance policy with a deductible of at least $1,350 for single coverage or $2,700 for family coverage. You’re now able to contribute up to $3,500 to an HSA if you have single coverage or up to $7,000 for family coverage, which is slightly more than the 2018 limits. If you’re 55 years of age or older in 2019, you’ll continue to be able to contribute an extra $1,000. HSA’s include complex details and are not right for everyone, so please call us to see if this makes sense for you.

Conclusion

Filing your 2018 taxes will include many changes from previous years. The new tax rates, and many of the changes that were approved, are set to expire after 2025. An essential part of maintaining your overall financial health is attempting to keep your tax liability to a minimum. Managing wealth involves careful planning, and staying updated and informed of any changes that may affect you. One of our primary goals is to keep you informed of the changes that will be affecting investors like you. We believe that taking a proactive approach is better than a reactive approach—especially regarding income tax strategies!

How long should I keep my records?

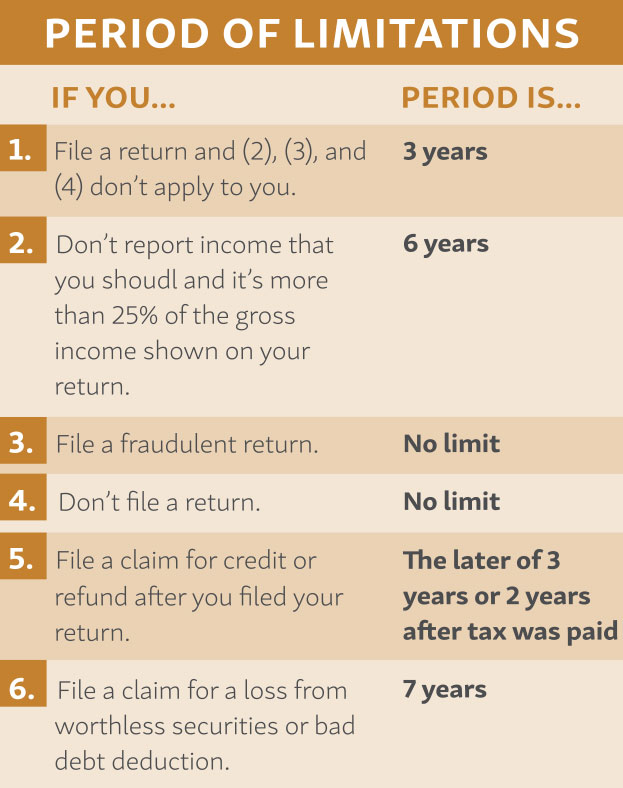

According to IRS Publication 17, you must keep your records as long as they may be needed for the administration of any provision of the Internal Revenue Code. Generally, this means you must keep records that support items shown on your return until the period of limitations for that return runs out. The period of limitations is the period of time in which you can amend your return to claim a credit or refund or the IRS can assess additional tax.

According to IRS Publication 17, you must keep your records as long as they may be needed for the administration of any provision of the Internal Revenue Code. Generally, this means you must keep records that support items shown on your return until the period of limitations for that return runs out. The period of limitations is the period of time in which you can amend your return to claim a credit or refund or the IRS can assess additional tax.

This table is directly taken from IRS Publication 17 and contains the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period beginning after the return was filed. Returns filed before the due date are treated as being filed on the due date.

We Welcome Questions

While no financial professional can guarantee any type of specific return, we strive to continually oversee your situation and our recommendations.

We pride ourselves in monitoring the market environment and offering all clients a financial review when necessary. If you have any questions or items you would like to discuss, please contact us and we would be happy to assist you!