Back to the Basics: Social Security’s Health and Taxation

After decades of doing your job, saving money, and just plain navigating life, retirement approaches and shocks you with its complexity. The number of things to consider when planning a retirement is daunting, and Social Security is no exception. While the options have been reduced slightly, there’s still a lot to consider when claiming the benefit that you’ve funded and earned after all those years. I’d like to clarify just a few aspects of Social Security: how it’s funded and how it’s taxed when received.

First, consider how Social Security is funded. It’s financed through a dedicated payroll tax as well as funds from two trusts. Employers and employees each pay 6.2% of wages into Social Security, while the self-employed pay 12.4% of earnings. According to Social Security’s website, in 2023, approximately 80% of total Social Security income came from payroll taxes, while another 12% came from interest earnings; the rest from other sources.

I share this because many people have heard that Social Security is going bankrupt. While under current law, the trust funds will be depleted by 2034, many changes are being considered to avoid that, and the vast majority of benefits are paid by ongoing taxes which aren’t going away. So, Social Security isn’t almost out of money, but something needs to be done to keep benefits from dropping in the future should the trust funds run out.

And how about the taxes paid on your Social Security Income? Taxes are paid from each paycheck while you’re working, then Social Security Income can be taxable as well, which leads many people to emphatically exclaim… “that’s double taxation!” Well, sort of, but not quite. The Social Security tax on wages while working is what actually creates the benefit received during retirement; it’s the equivalent of having money deducted from your paycheck to invest in a 401(k). The taxation of wages was the reason you have Social Security benefits coming to you at all. Will those benefits be taxed when received? Quite possibly, but we’ll get to that.

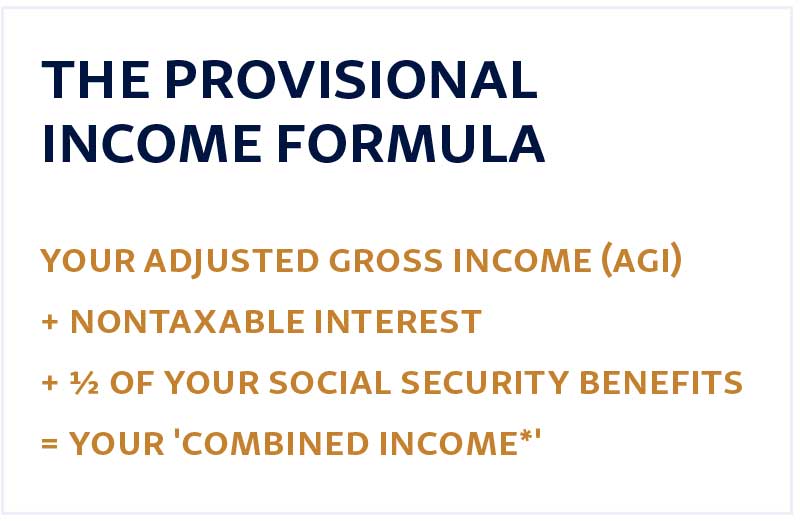

So, what are the tax rules of Social Security Income? In short, Social Security benefits are taxable to you if you make a certain amount of money from other sources. The means by which your Social Security taxes are determined is called the ‘provisional income formula.’

Once you’ve determined your ‘combined income’, you apply that amount to the following (example is for a married couple filing a joint return; single filers have different amounts):

If you and your spouse have a combined income* that is:

• between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits,

• more than $44,000, up to 85 percent of your benefits may be taxable.

So, while you may have heard that up to 85% of Social Security benefits are taxable, the actual amount is based on your combined income. Just to clarify, because up to 85% of benefits are taxable doesn’t mean you’re paying 85% tax on those benefits. Instead, it means not all of your Social Security check is taxable, just part of it.

As this should illustrate, Social Security taxation is not necessarily simple to grasp, but there’s a formula available to determine how much of your benefit will be taxable to you. Additionally, the system isn’t bankrupt, but adjustments will need to be made in order to ensure future workers and retirees will receive the full amount of benefits they’re entitled to.